Financing Solutions To

Unlock Your Growth.

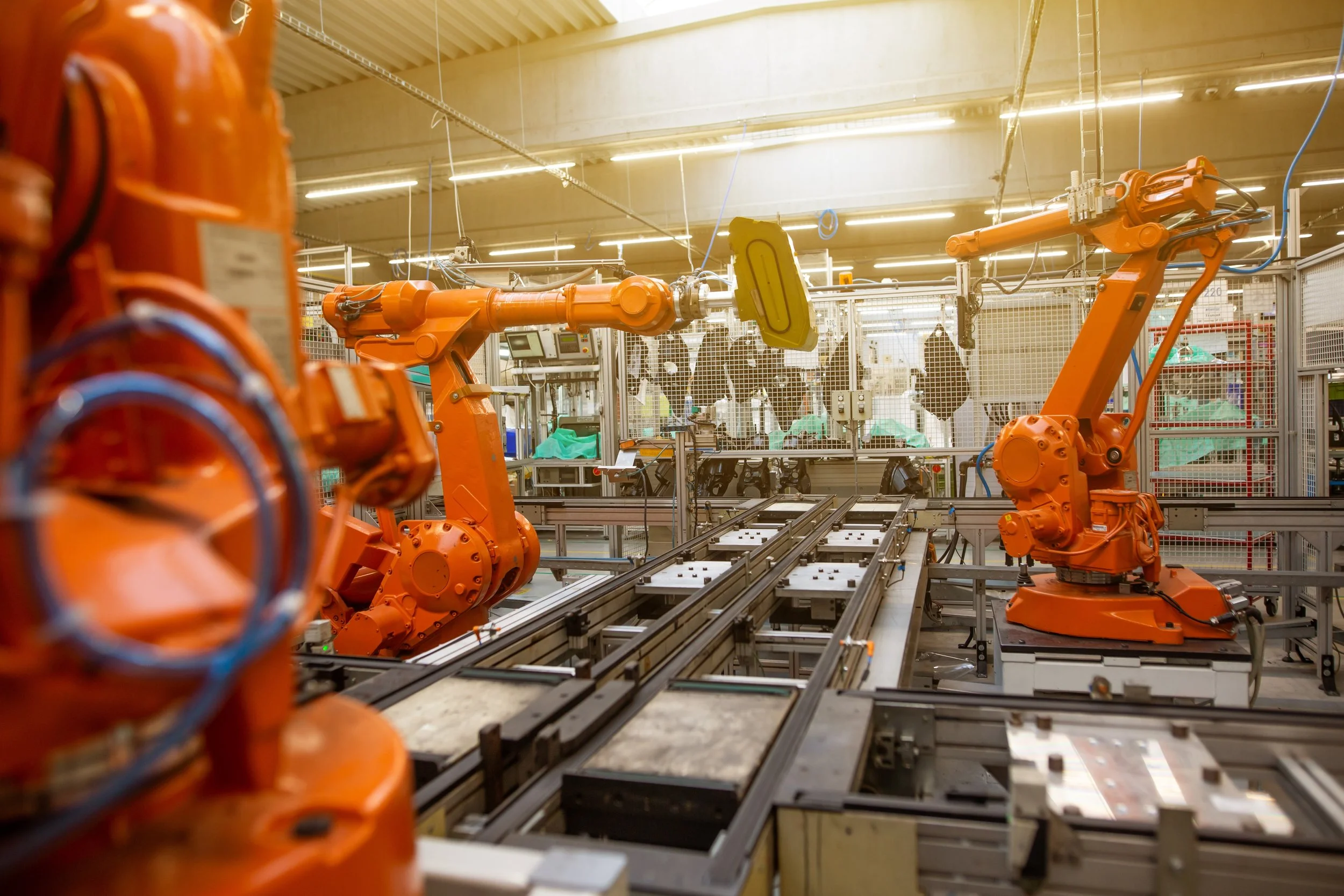

Equipment Lease financing

Secure revenue-generating equipment with terms tailored to your business – without tying up your capital budget or risky lines of credit.

equipment you need

No money down

Immediate positive return

Options

Capital Lease

Finance the full value of new equipment. You hold the title and own the equipment at the end of the lease.

Operating Lease

Finance a portion of the value of new equipment, with an option to purchase for fair market value at the end of the lease. Lease payments can be deducted as expenses.

Common Terms

Finance amount: $50K - $200M+

Term: 12 - 72 months

Payment schedule: monthly, fixed or seasonal

Industry: Any

Faqs

-

Costs like delivery, sales tax, and maintenance agreements can be included in the lease, along with all hard costs.

-

For solutions below $350K, we only require a credit application. Amounts above $350K require more detailed company financial information for approval.

-

Application-only approvals are regularly communicated within two hours of submission. Larger deals requiring the review of financials take longer but are regularly approved within one week.

-

As an independent lender without the regulatory constraints of larger banks, Battle Horse can offer more flexible terms and provide solutions for underserved customers like startups and small businesses.

-

Many businesses have seasonal cycles. In many circumstances, we can weight payment structures to a company’s more profitable months.

-

Most leases are secured by the value of the equipment itself but they can also include other owned assets and corporate or personal guarantees to replace a downpayment.

-

Many businesses choose to defer their first payments while beginning to operate equipment to create an initial boost of capital. The specific circumstances of each deal determine the ability to defer payment.

Explore Your Opportunities

Connect with a Battle Horse Solutions Provider for expert guidance and an equipment plan that does more for you.

Equipment Refinancing

Lower lease payments and get an infusion of capital to invest in other areas of your business.

Lower payments

better terms

more cash

Options

Refinancing Leases or Loans

Finance the full value of new equipment. You hold the title and own the equipment at the end of the lease.

Sale-Leaseback

Receive a one-time cash payment for currently owned equipment that you keep using, with repayment across the lease term.

Common Terms

Finance amount: $50K - $200M+

Term: 12 - 72 months

Payment schedule: monthly, fixed or seasonal

Industry: Any

Faqs

-

With Battle Horse, you can refinance leases or loans from other institutions to lower payment, get better terms, or consolidate with one monthly payment.

-

A new equipment finance agreement can be used to pay off an existing traditional loan.

-

In most cases, the penalties resulting from ending existing leases early can be included in the amount refinanced.

-

Unencumbered assets with remaining useful life can be purchased by Battle Horse for cash and leased back to your company while you keep using it.

Apply NOw

Industries We Serve